Everything You Required to Learn About Offshore Business Formation

Navigating the intricacies of overseas business formation can be a complicated job for numerous people and businesses looking to broaden their procedures internationally. The allure of tax advantages, asset defense, and boosted privacy often attracts rate of interest towards developing offshore entities. Nonetheless, the complex web of lawful needs, regulative frameworks, and economic considerations can posture considerable challenges. Recognizing the nuances of overseas company development is essential for making educated decisions in a globalized organization landscape. By deciphering the layers of advantages, difficulties, actions, tax ramifications, and conformity responsibilities related to offshore firm formation, one can acquire a thorough insight right into this multifaceted topic.

Advantages of Offshore Business Development

The advantages of establishing an offshore company are complex and can dramatically profit businesses and people looking for tactical financial planning. Offshore companies are usually subject to beneficial tax regulations, enabling for decreased tax obligation obligations and boosted earnings.

In addition, offshore firms can assist in global business procedures by providing accessibility to global markets, expanding income streams, and improving service integrity on a worldwide range. By developing an offshore presence, services can tap right into brand-new opportunities for development and expansion past their domestic boundaries.

Usual Challenges Encountered

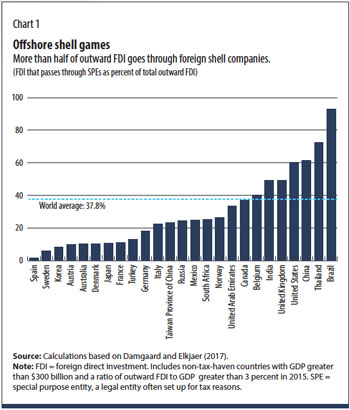

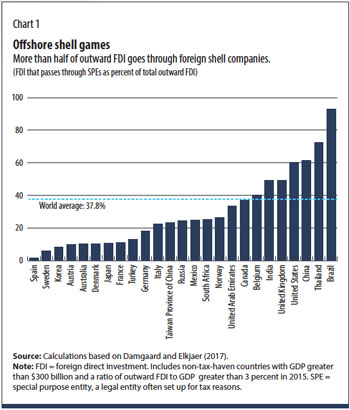

Regardless of the numerous benefits connected with offshore company formation, services and individuals typically encounter common challenges that can impact their operations and decision-making procedures. Browsing differing legal structures, tax obligation legislations, and reporting criteria throughout different jurisdictions can be daunting and lengthy.

An additional typical obstacle is the risk of reputational damage. Offshore business are often viewed with uncertainty due to issues about tax evasion, money laundering, and absence of openness. Taking care of and minimizing these assumptions can be tough, specifically in an increasingly scrutinized global company atmosphere.

Moreover, establishing and maintaining reliable interaction and oversight with overseas operations can be challenging because of geographical ranges, cultural distinctions, and time zone variations. This can lead to misconceptions, delays in decision-making, and troubles in monitoring the performance of offshore entities. Overcoming these challenges needs cautious planning, diligent threat administration, and a complete understanding of the regulative landscape in offshore jurisdictions.

Steps to Type an Offshore Company

Establishing an overseas company includes a collection of lawfully certified and calculated steps to guarantee a smooth and effective formation process. The initial action is to choose the overseas territory that ideal fits your service demands. It is get more vital to comply with recurring coverage and compliance requirements to preserve the great standing of the offshore business.

Tax Implications and Factors To Consider

Purposefully browsing tax obligation implications is crucial when creating an offshore company. One of the primary factors individuals or organizations go with overseas business development is to take advantage of tax obligation advantages. It is necessary to abide and understand with both the tax laws of the overseas jurisdiction and those of the home country to ensure legal tax optimization.

Offshore firms are typically based on favorable tax routines, such as reduced or absolutely no company tax prices, exemptions on particular kinds of revenue, or tax obligation deferral choices. While these benefits can lead to significant financial savings, it is necessary to structure the overseas firm in a manner that aligns with tax obligation regulations to stay clear of prospective lawful concerns.

In addition, it is crucial to take into consideration the implications of Controlled Foreign Corporation (CFC) rules, Transfer Pricing guidelines, and other worldwide tax regulations that might influence the tax treatment of an offshore company. Seeking advice from tax professionals or specialists with know-how in overseas taxes can help browse these complexities and ensure compliance with appropriate tax obligation guidelines.

Handling Conformity and Laws

Browsing with the detailed web of compliance demands and laws is necessary for making sure the smooth procedure of an offshore company, especially in light of tax obligation implications and considerations. Offshore territories typically have specific regulations controling the development and operation of companies to Learn More avoid cash laundering, tax obligation evasion, and other immoral activities. It is crucial for firms to stay abreast of these guidelines to stay clear of significant fines, legal issues, and even the opportunity of being closed down.

To take care of compliance successfully, overseas firms ought to designate knowledgeable professionals who comprehend the local regulations and worldwide criteria. These experts can aid in developing proper governance frameworks, preserving precise financial records, and sending called for reports to regulatory authorities. Normal audits and evaluations ought to be performed to make sure continuous compliance with all relevant laws and guidelines.

In addition, remaining notified regarding adjustments in regulation and adapting methods accordingly is crucial for long-lasting success. Failing to abide by guidelines can stain the reputation of the business and weblink result in serious repercussions, highlighting the significance of focusing on compliance within the offshore business's functional structure.

Verdict

To conclude, offshore company development uses various advantages, but additionally includes challenges such as tax obligation ramifications and compliance needs - offshore company formation. By following the essential actions and thinking about all elements of developing an offshore business, organizations can make use of global opportunities while handling dangers effectively. It is important to stay informed about laws and stay certified to guarantee the success and longevity of the offshore company venture

By untangling the layers of benefits, difficulties, steps, tax obligation implications, and compliance responsibilities associated with offshore business development, one can gain a comprehensive insight right into this complex subject.

Offshore companies are often subject to positive tax obligation regulations, enabling for lowered tax responsibilities and increased profits. One of the primary reasons individuals or services choose for overseas firm development is to profit from tax advantages. Offshore territories typically have specific legislations regulating the formation and procedure of companies to stop cash laundering, tax evasion, and various other illegal activities.In verdict, offshore business development provides various benefits, but additionally comes with difficulties such as tax obligation effects and conformity requirements.